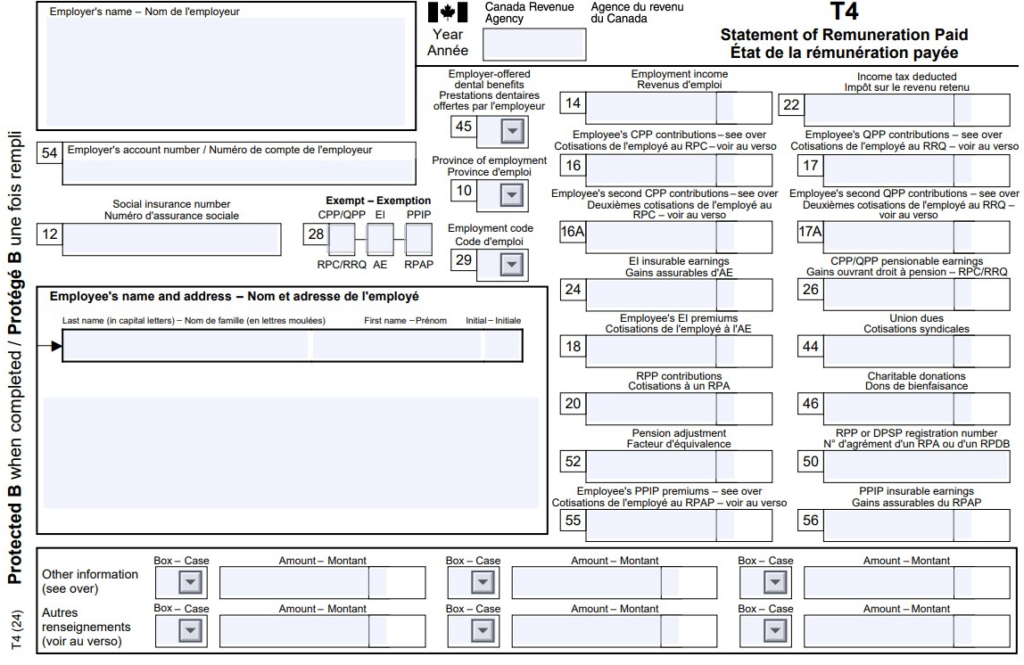

T4 slip is a summary of your employment earnings and deductions for the year. This year you may find that CRA has revised the form to include a few more boxes.

When to issue

If you are an employer (resident or non-resident) and you paid your employees employment income, commissions, taxable allowances and benefits, fishing income, or any other remuneration, you must issue a T4 slip if any of the following apply:

- You deducted CPP/QPP, EI, PPIP, or income tax from remuneration paid to your employee

- If the remuneration paid to your employee is not included on the exception list, the total of all remuneration paid in the calendar year was more than $500 (under the CRA administrative policy)

Don’t be too alarmed!!!

What is Reported

- Salary or wages

- Tips or gratuities

- Bonuses

- Vacation pay

- Employment commissions

- Gross and insurable earnings of self-employed fishers

- Taxable benefits or allowances

- Retiring allowances

- Deductions withheld during the year

- Pension adjustment (PA) amounts for employees who accrued a benefit for the year under your registered pension plan (RPP) or deferred profit sharing plan (DPSP)

- Security options benefits provided to an employee, former employee or non-resident employee

What is not Reported

- If you paid pensions, lump-sum payments, annuities, or other income (including amounts paid to a proprietor or partner of an unincorporated business) use: T4A slips – Statement of Pension, Retirement, Annuity, and Other Income

- If you provide former employees or retirees with taxable group term life insurance benefits and the amount of the benefit is greater than $50 use: T4A slips – Statement of pension, retirement, annuity, and other income

- If you paid amounts from a retirement compensation agreement use: T4A-RCA slips – Retirement Compensation Arrangement (RCA) trust

- If you paid fees (except for director fees), commissions, or other amounts to a non-resident for services rendered in Canada, other than employment situations: use: T4A-NR slips – Payments to non-residents for services provided in Canada

- If you are a payer with construction as your primary source of business income and must report payments to contractors use: T5018 – Statement of contract payments

- If you are a federal department, agency, or a Crown corporation and must report government service contracts use: T1204 – Government services contract payments

Contact your tax professional if you need a better understanding of your T4 Slips.

Remember also that If you do not get your T4 slip by the end of February, ask your employer for a copy. If you cannot get a copy in time to complete your return, you may be able to view your tax information online using the My Account for Individuals service (see my blog on Notice of Assessment – Easy guide)

Refer to : https://www.canada.ca/en/revenue-agency for more information: